Fill this quick form we are here to help you.

LIC kanyadan Policy is also known as Jeevan Lakshya Plan. It is the best gift for your daughter which provides her financial benefits in education and Marriage. Example: If you save 75 per day, your daughter will get 14 Lacs at the time of marriage. Its an example, this plan can also be customized as per your daughter’s educational need. You can call or mail our Kanyadan LIC advisor to get complete details.

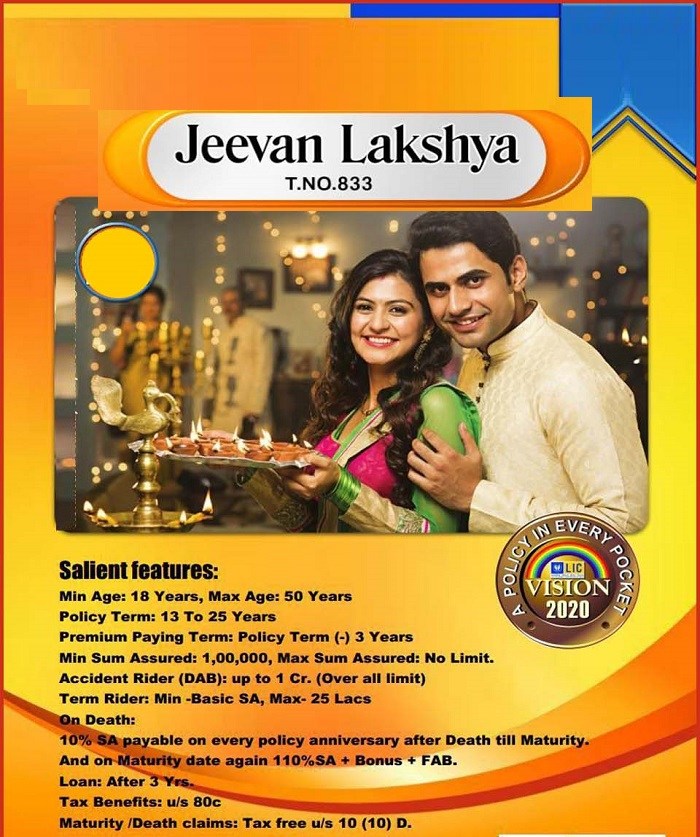

LIC’s Jeevan lakshya plan is a participating non-linked plan which offers an attractive combination of protection and saving. This plan provides for annual income benefit that may help to fulfill the needs of the family,primarily for the benefit of children, in case of unfortunate death of policyholder any time before maturity and a lump sum amount at the time of maturity irrespective of survival of the policyholder. This plan also takes care of liquidity needs through its loan facility.

If policy holder survives till the end of the policy term having paid all due premiums,

the benefits from the policy would be:

Basic Sum Assured + Vested Simple Revisionary bonuses + Final Additional bonus (if any)

In case of unfortunate event of death of policy holder happens during the policy term, 10% of the

basic sum assured amount will be given to the nominee on every policy anniversary from the year of

death till the date of maturity.

| Minimum Age to Apply | 18 Years (Completed) |

| Maximum Age to Apply | 50 Years (Nearest Birthday) |

| Policy Term | 13 to 25 years |

| Premium Paying Term | (Policy Term – 3) years |

| Maximum Maturity Age | 65 Years |

| Premium Paying Mode | Yearly, Half Yearly, Quarterly, Monthly (ECS) |

| Sum Assured | 100000 and above (in multiples of 10000) |

| Loan | After 2 Years |